Nvidia's 2026 Updates

How do you keep up with Nvidia and how they prepare for the future.

That Rubin arrives early almost feels like a counter to the AI bubble talk.

Good Morning,

Where do we even start with Nvidia? Easily the center of the Generative AI and AI datacenter movement, their more frequent events, interviews, PR and news make them difficult to fully comprehend. Such an AI GPU monopoly. So much crazy demand!

Their events appear have become more frequent. Their tone a bit more desperate. Why is that? 😕

Nvidia’s presence in Las Vegas could really be felt in early 2026. So what really stood out? Did they say anything new and impactful.

Vera Rubin launch

Alpamayo Family of Open-Source AI Models

Vera Rubin

How do we reconcile the immensity of what Nvidia is becoming? As OpenAI fades, As Copilot is irrelevant, as Meta stumbles, as Apple goes on device and as Amazon tries to relaunch Alexa? Few winners indeed, as M&A begins to accelerate.

Video: 2:44

“Vera Rubin is designed to address this fundamental challenge that we have: The amount of computation necessary for AI is skyrocketing.” Huang said. “Today, I can tell you that Vera Rubin is in full production.”

Their interest in owning the full stack, partnerships, open-source models, robotics and quantum computing is fairly strategic! But is it early, will the AI chip space get more competitive before those other bets materialize?

Watch Nvidia’s Full CES Event, January, 2026.

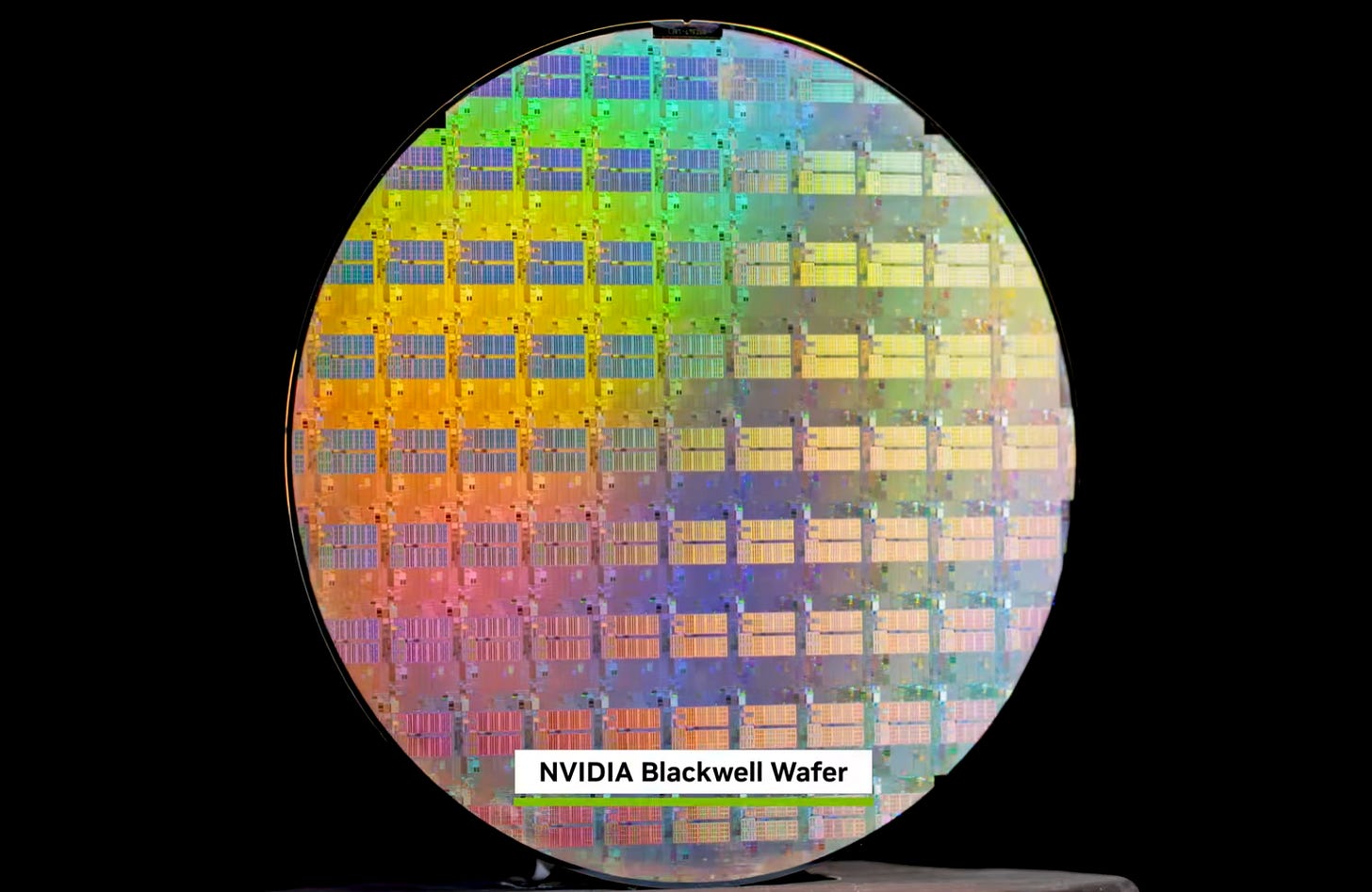

The problem becomes BigTech will need the latest and the greatest chips in their Datacenters because the difference between iterations is so large, Nvidia’s cash cow isn’t an honest business in a sense:

The Rubin GPU boasts five times more AI training compute power than Blackwell.

While they already own the GPU stack, they are expanding their strategic open-source model bets in the usual suspects:

Autonomous driving

Physical AI and robotics

Biomedical and Science

In new directions like agentic AI

Nvidia’s Open Source Model Universe Expands in 2026

🗣️NVIDIA Nemotron for agentic AI

💪NVIDIA Cosmos for physical AI

🚙 NVIDIA Alpamayo for AVs (Props that they can make a nice video, they ain’t no Wayve)

🤖 NVIDIA Isaac GR00T for robotics

🧬 NVIDIA Clara for biomedical

I mean it’s a coherent strategy which feels more pragmatic and anticipatory than what Microsoft, Amazon, Meta, Apple or even OpenAI are doing frankly. The bets they are placing in funding AI startups has also been highly strategic.

How Surprising is Alpamayo for AVs really?

It’s not at all surprising, given Nvidia’s AV business. The above tech bro also seems to think Tesla is in the running (wrong again). Even media Execs have been brainwashed by the hype while, Baidu Apollo goes global, Wayve thrives and even Amazon’s unit is making tremendous strides. Anyways Nvidia’s AV model doesn’t sound too serious yet: (just like Tesla’s Robotaxis).

Nvidia seems to be making a lot more LLMs. That is the notable difference in 2026. They are going for open-source, where China dominated 2025.

Alpamayo is a family of open-source AI models, simulation tools, and datasets designed to accelerate the development of safe, reasoning-based Level 4 autonomous vehicles.

Announced at CES 2026 (January 2026), it enables vehicles to perceive surroundings, reason through complex or rare (”long-tail”) scenarios step-by-step like humans, and generate driving actions with explainable logic—improving safety, transparency, and trust compared to traditional “black-box” systems.

Key Components:

Alpamayo 1: A 10-billion-parameter vision-language-action (VLA) model that uses chain-of-thought reasoning on video/sensor inputs to predict trajectories and output human-readable explanations (e.g., “Nudge left to avoid construction cones”).

AlpaSim: An open-source simulation framework for closed-loop testing and evaluation of reasoning-based AV models.

Physical AI Open Datasets: Over 1,700 hours of diverse real-world driving data (from 25+ countries), including edge cases, available on Hugging Face.

The portfolio integrates with NVIDIA’s DRIVE platform and is supported by partners like Mercedes-Benz (first deployment in the CLA model starting Q1 2026), JLR, Lucid, and Uber. It’s openly available on GitHub and Hugging Face to foster industry-wide innovation in physical AI for autonomy.

Bottom line: Alpamayo 1, AlpaSim and Physical AI Open Datasets enable the development of vehicles that perceive, reason and act with humanlike judgment — enabling developers to fine-tune, distill and test models that unlock greater safety, robustness and scalability.

Isaac GR00T N1.6 is an open reasoning vision language action (VLA) model, purpose-built for humanoid robots, that unlocks full body control and uses NVIDIA Cosmos Reason for better reasoning and contextual understanding.

Nvidia’s Full Stack Approach

Nvidia in 2026 is trying to position itself as an innovator and not just a hardware partner to all of these incredible companies. I don’t really buy it yet, they make most of their revenue just from datacenters and GPU sales.

But their developer ecosystem is emerging.

Robotics and Quantum computing are nowhere near prime time.

Nvidia Cosmos

Is Physical AI really going to be a thing soon?

Cosmos Reason 2 is a new, leaderboard-topping reasoning VLM that helps robots and AI agents see, understand and interact with higher accuracy in the physical world.

Cosmos Transfer 2.5 and Cosmos Predict 2.5 are leading models that generate large-scale synthetic videos across diverse environments and conditions.

Hype vs. Reality

Jensen Huang takes a good interview, but so much of their PR is more bark than bite. So much seems positioned for investors and market confidence. Listen they make great hardware, have made smart acquisitions, but they really don’t have a very well diversified business model outside of AI Chips. At least they have a good gaming business!

Check out everything they announced at CES 2026 in 9 minutes (CNET).

Vera Rubin as “six chips that make one AI supercomputer”

Okay then, let’s list them out for good measure: Those six chips include the Vera CPU, Rubin GPU, NVLink 6th-gen switch, Connect-X9 NIC, BlueField4 DPU, and Spectrum-X 102.4T CPO.

TSMC is going to raise prices, that means Nvidia will as well with those crazy margins.

Takeaways

Nvidia claims the Rubin GPU is capable of delivering five times as much AI training compute as Blackwell. It is a few months early, which is a bonus.

Having a full-stack approach to LLMs gives them some emerging tech credibility, way before those other businesses have scaled. AVs, robotics, Quantum and Biotech. They will make more acquisitions to bolster these eventually. They won’t compete well vs. pure play startups in these domains though anytime soon.

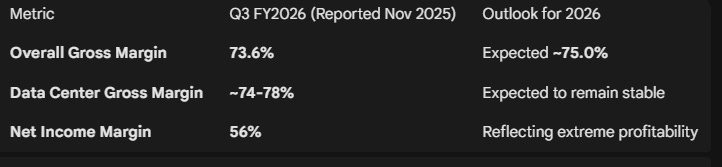

Nvidia is great for Killer Margins

Nvidia’s monopoly on GPUs means they have stellar margins. This underpins their entire business, only while demand for their product is great.

If you take those two things away, what happens to this company? Is CUDA and acquisitions like Groq adding to their moat? How long can it last? How do they actually make money in a world with less demand for datacenters? I don’t know. Great partner network, nice interviews.

What Happens when the Insanity Ends?

How long can Nvidia’s “insane demand” for GPUs last? And what happens to the company when the peak cash cow of their only viable revenue source is over? Nobody has given a good explanation. The semiconductor industry is cyclical by nature, Nvidia’s market cap rise has lifted the entire Semiconductor sector with it, but it’s boosted mainly on myths of scaling.

Jensen Huang knows what happens. NVIDIA’s business model relies heavily on its near-monopoly in AI accelerators (over 80-90% market share in data center GPUs), high gross margins (mid-70s%), and the CUDA software ecosystem that locks in developers. These conditions could change, even with the insane favoritism by the Trump Administration we saw in 2025.

What competition?

Custom ASICs could capture 15-25% of the market by 2028, primarily for internal inference workloads. That’s not even counting what Huawei and other Chinese AI Chip startups become eventually. Google TPUs might just be more efficient for what’s needed as soon as 2027. Nvidia will eventually have to lower its prices and not just do circular financing with its biggest customers. What does Nvidia look like then?

Even without external threats, the energy grid bottlenecks of the U.S. and less demand for datacenters will come sooner than later. The U.S. is building out too much infrastructure with GPUs that become obsolete relatively quickly thanks to Nvidia itself. Geopolitical issues with China and Taiwan for TSMC remain a significant risk factor in the 2026 to 2030 period.

Watch the Keynote CES 2026

Jensen Huang Keynote at CES. Begins at around 20 minutes.

If demand for Nvidia's gpus were to tank, it would torpedo the NASDAQ 100 and the entire inflated semiconductor stock boom.

Excellent breakdown of the CES momentum, Michael. However, from a GTS (General Theory System) perspective, the 'early' arrival of Vera Rubin looks less like a strategic flex and more like a tactical necessity to mask the Inventory Leak in the Blackwell cycle.

Our RCP regression suggests that the pivot into Alpamayo and Physical AI is a defensive Matrix (M) expansion. As Tier-1 clients accelerate their move toward silicon autonomy, NVIDIA is forced to commoditize its software stack to keep the hardware relevant. We’ve calculated a 40% systemic contraction by Q2. The tension (MFn) is reaching a breaking point that PR can no longer stabilize. Detailed diagnostic is on my profile for those tracking the structural disconnect.